How to sell your coworking business

DenSwap is committed to a straightforward selling process that works with you to find the next stage of your company. We understand that every space is unique and that customers are members and friends. During this process, we’ll help you and your community be matched with the right buyer that shares your vision. As soon as you sign a listing agreement, we roll up our sleeves and handle every step of the process to ensure we find you the right offer from the right buyer.

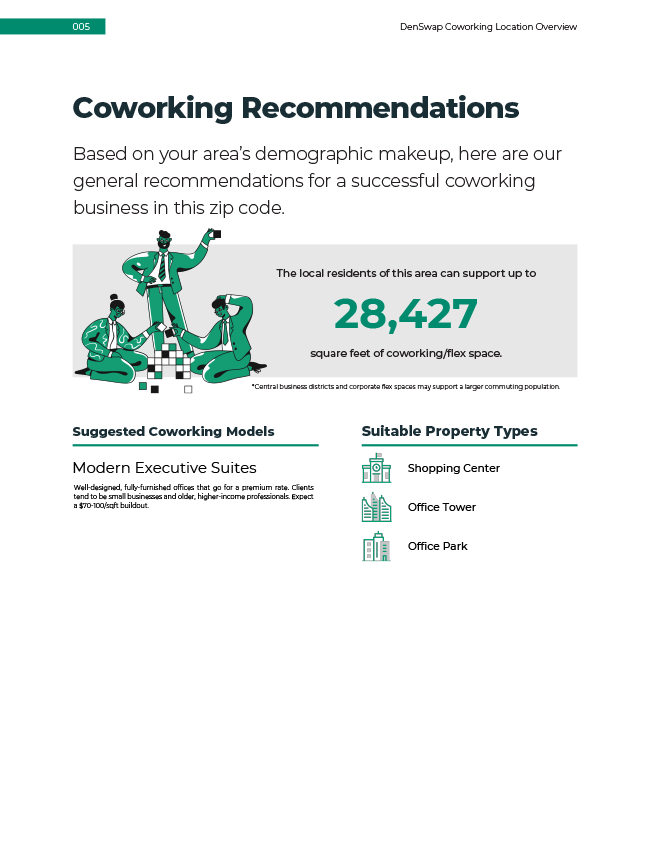

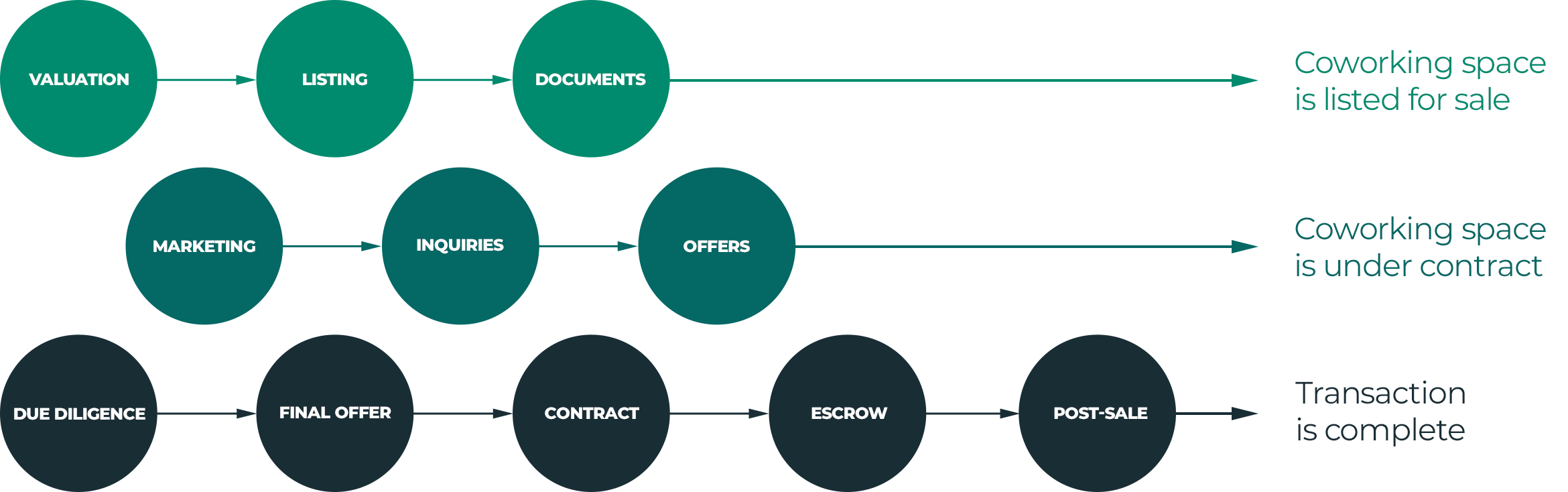

The first process is Preparation – you’ll want to find the right asking price for your business, create the right listing, and prepare a set of documents to present to interested buyers. Once the preparation stage is over, we’ll list your business and move to Negotiation. Negotiation is the process of marketing your business with DenSwap, communicating with potential buyers (including presenting the document packet and optimization reports, and giving space tours), and receiving offers from buyers. Once you’ve chosen an offer, we move to Transition – the process of verifying the business and passing it off to the buyer.

Perform the valuation

We appraise your coworking business based on many factors. As a general rule, your space is valued by its annual profit (including owner compensation) times a multiple in the 1-5x range. What makes that multiple higher or lower depends on several factors, such as;

- Occupancy level of your space

- The contracts and attrition rate of your tenants

- How long is left on your lease

- The size of your space

- The age of the business

- How strong the brand is

- How reliant the business is on you as the owner

- What the growth prospects are

- The responsibilities of the team, the number of employees

- Whether you have documented, formalized procedures

- The space’s growth (declining, steady, or growing)

- The city’s growth (declining, steady, or growing)

To get a good sense of where you’re at, try our coworking valuation calculator for a general answer in 10 minutes or less. Once you’ve done that, we can follow up and give a more detailed estimate and suggestions where to go next.

See how much your space is worth. Our valuation tool can estimate the value of your space in minutes.

Open the Coworking Valuation CalculatorCreate the Listing

Once you’re ready, you can create a listing to sell your coworking business on DenSwap. At the end of it, you’ll agree to the terms between you as a seller and DenSwap. Once submitted, we’ll review your listing and ensure you’ve got enough information for interested buyers.

Listings can be public or private until an NDA is signed. It’s your call, but private listings get about 10% of the inquiries that public listings do. It generally takes 3-4 weeks to finalize a listing and prepare documents for the next step, so start early – we won’t launch your listing until you’re completely satisfied and ready to progress.

Prepare the document packet and optimization report

After you’ve created your listing, we’ll ask for general business documents to help prospective buyers understand your business. At a minimum, you should have:

- Profit and Loss statements for the past 2-3 years

- Current balance sheet

- A copy of your lease agreement

- Your space’s floor plan

- Your current rent roll

- Sample tenant contract

Some buyers might ask for the business tax returns (to verify your P&Ls), ancillary contracts with vendors, and so on. We’ll ask for those if it comes up.

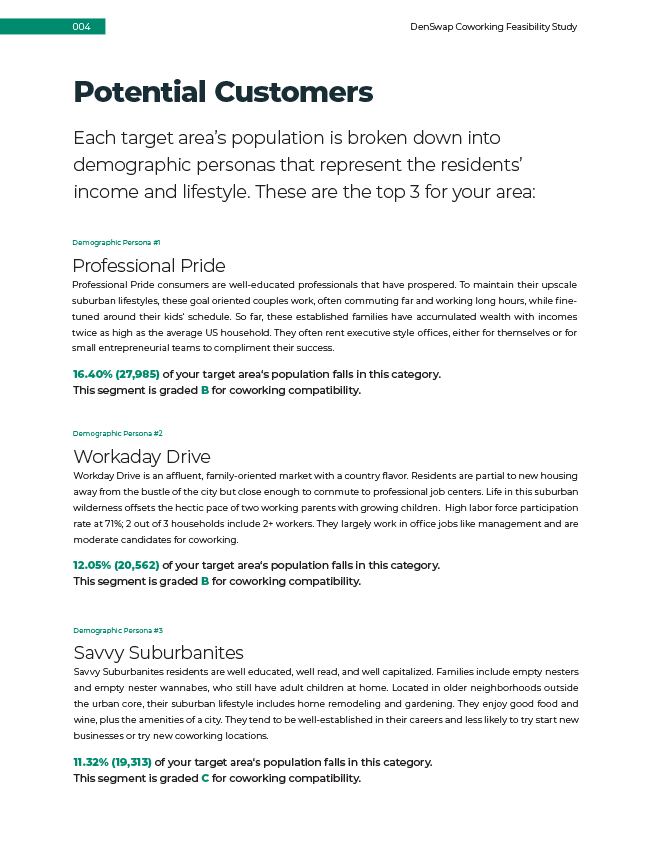

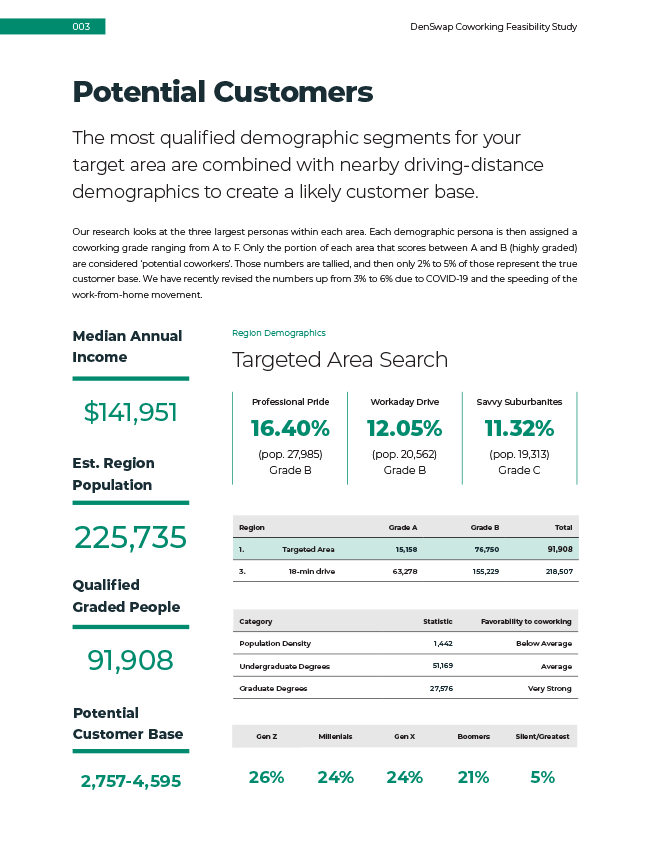

Once we receive your business documents, we’ll review and scan to make sure everything is consistent and clear for both you and your prospective buyers. Depending on the space, we might also create an optimization report – a consultant-led report that assesses your space’s strengths and weaknesses, and gives prospective buyers insight into the growth potential of your business. These optimization reports are powerful selling tools that our buyers routinely look for as they enter or expand into your coworking market.

Check out a sample optimization report to see how we present your space to our buyers.

Download optimization report PDFMarketing your business

Once the listing and reports are complete, it’s time to take your listing live on the DenSwap marketplace and present your business to buyers. We market your business in several ways:

- We prepare a prospectus email to our private buyers list, which has buyers specifically interested in and experience with the coworking community. These buyers are typically larger coworking chains and CRE investors that we’ve cultivated relationships with to buy businesses such as yours.

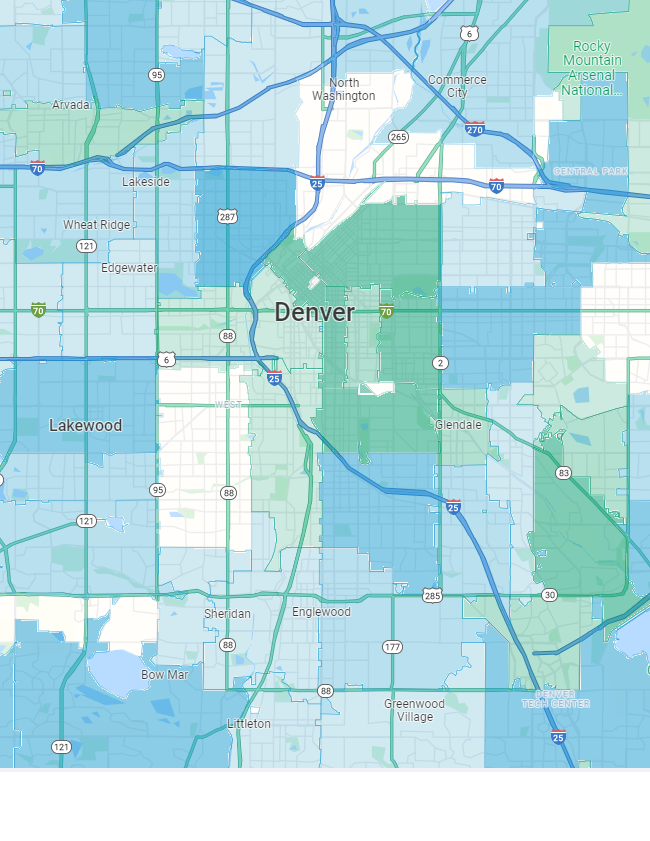

- We advertise directly on external marketing channels, including public outlets like BizBuySell, regional coworking associations and co-ops, and our own proprietary tools like the Coworking Heatmap used by researchers and buyers in the coworking industry.

- We directly reach out to potential acquirers that we think are the most likely buyers. Our buyers fill out an interest survey, which is periodically updated, to ensure we’re finding the best fit possible.

Manage buyer inquiries

Buyers that are interested either call us or email their questions. We generally answer those on your behalf, and manage the process to make it as easy as possible on you. When buyers are ready to take the conversation to the next level, they’ll contact you on DenSwap’s communication platform – your one-stop dashboard for all purchase inquiries. You and the buyers are able to discuss information, upload documents to our secure legal document vault, and receive offers. As a third-party, we keep all discussion in one place to ensure you have legal protection in case of a dispute during the contract and escrow process.

Serious buyers will request a management meeting with you as the owner to talk about the business, how it’s run, and ask additional questions. We guide you through every step of this process, screening these calls and protecting your time.

Deal structuring and manage LOIs

The letter of intent is an offer to purchase your business. Offers will come in through the DenSwap platform and saved so you can review side-by-side. Our job is to get multiple letters of intent to achieve the best possible offer for you. Offers often have a variety of terms and our goal is to create a competitive environment so you get to choose which is the best deal for you. When you have an offer you’re ready to accept, you’ll accept the offer in your DenSwap dashboard and sign the Letter of Intent to move forward to the due diligence process.

Manage Due Diligence process

The chosen buyer gets a 4-8-week due diligence period to verify all the numbers & documentation, and ask any remaining questions they have about your business. Due diligence can be an intense process. We will help you to maneuver through this process and will help you to gather paperwork and answer any buyer questions, ensuring that the deal remains intact and progresses successfully towards closing.

Review and negotiate final offer

The final offer is then negotiated. Occasionally, there are items that come up in Due Diligence that require an adjustment on the initial offer price. Price and value are two very different concepts, and different buyers can have dramatically differing views on the value of your company. The more potential buyers you hear from, the better you will know what the market believes the current price of your business is. Even more importantly, you’ll be able to identify those buyers who recognize the value of your business and are willing to pay top dollar for it.

Review Buy/Sell agreement

The buyer will oversee getting the buy/sell agreement or the contract for buying the company.

This is generally in the form of an asset purchase agreement, which means the buyer is going to acquire the assets of the company, or in the form of a stock purchase agreement where the buyer acquires the shares of the company.

We will answer questions and help to facilitate an expedient closing, but we aren’t lawyers and can not give legal advice. We strongly advise hiring outside legal counsel to carefully review the agreement. If you don’t have a lawyer you’ve worked with regarding your coworking space previously, we have trusted lawyers we can refer you to.

Manage escrow process

Once the contract is signed, the buyer puts money into a escrow bank account while the seller transfers all the assets or the shares of the business to the buyer. DenSwap includes a built-in escrow service inside the platform and is included for free as part of our service to buyers and sellers. This escrow platform verifies the identity of both parties, sets up the bank transfer, and can arbitrate in case of a dispute so all parties are protected. Once the company transfer is completed, the escrow company releases the funds to the seller.

Coordinate post-sale training

There’s generally a 4-8-week training period that’s expected after the sale closes for the buyer to be taught about the business – the exact terms and timeline are negotiated and covered in the purchase agreement. Anything over this time frame can be negotiated as a paid consulting agreement.

Full speed ahead.

We know most coworking owners haven’t sold a business before, and we’re here to make the process as simple and pain-free as possible. If you’re thinking about selling in the next year, reach out to us and get the conversation going.