How to find a location for your next coworking space

Among the hundred or so coworking chains out there, we see a few expansion patterns emerge over and over again. Let’s take a look at the most common ones to give you an idea of what’s been done before and give you a jumping off point for your research.

As you’re developing your brand and looking at other spaces to acquire, it’s important to think through your expansion strategy. At DenSwap, we’re big into data-driven decisions. We’ve done the research, built out the tools, and read all of the business journals out there to help our clients understand the market and create smart strategies for the future.

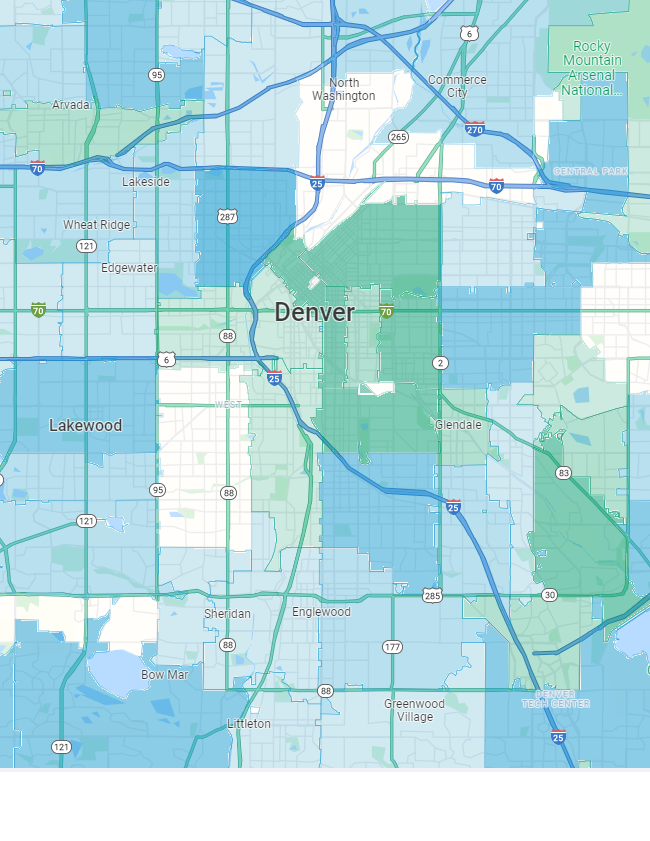

Find underserved neighborhoods for your next coworking location with our free interactive map.

Open the Coworking Heatmap to research trendsDowntown Core > Migrate to Suburbs

Thrive Workplace or Creative Density in Denver are two good examples of this trend – these are spaces that started with a single location (typically near a city core) and then expanded their brand to open sister spaces in underrepresented suburbs and exurbs in the surrounding metro. This is by far the most common expansion model we see, and there’s a couple of advantages to this strategy. First of all, it’s easy to maintain quality leadership and standards when the owner is able to drive to the new location when problems arise. Second, talking to your existing community can help identify solid locations and “seed groups” (members who are willing to relocate to the new location to help continue the community rhythms of the first location.)

That being said, opening a suburban campus can be drastically different from the original downtown location. Floor space may need to be reconfigured to accommodate client needs (office space tends to take priority over shared desks) and the community feel may be completely different. Be prepared to make adjustments to your secret sauce to accommodate local differences. Finally, there’s only so many locations you can open in most markets before you reach saturation. Unless you’re in a major metropolitan area like New York or Los Angeles, suburban locations in your immediate city should be strictly used to test your brand model and establishing stable (if somewhat boring) revenue before expanding to other markets.

Geographic Spread based on Regional Travel

A coworking chain’s competitive advantage can be its cost efficiencies, or it can have a unique value that it delivers to its customers. Coworking chains that focus on a specific customer type can expand into markets where their customers travel or relocate to. Midwest chains often start in Chicago or Minneapolis, but then they expand to Detroit, Indianapolis, or St. Louis. They become local alternatives to national chains because the customer only cares about the local major markets where their workers go to and their clients are.

We see regional chains growing in Texas, California, the Beltway, and the Midwest. A good example of this type of chain is Common Desk, which started in Dallas in 2012 and then expanded to other two major Texas cities before continuing to expand east. West coast coworking chains tend to be based in LA and expand outwards from there – Union Cowork, Cross Campus, and are good examples of LA-based chains that have expanded to fill California. MakeOffices is a good example of a beltway regional chain – they started in Washington DC and expanded north from there.

Regional chains are growing and powerful trend in the coworking movement. We firmly believe coworking will be dominated by smaller regional chains that understand their region, can build brand loyalty, and scale their business sustainably. The largest buyer segment we have at DenSwap are regional chains like these who are using the marketplace to consolidate their hold on their region and acquire their competitors. We expect this trend to continue through the 2020s until a majority of coworking spaces are owned by regional chains like these.

Geographic Spread based on Size Profile

Coworking spaces can specialize in a type of space or a type of neighborhood. Suburban spaces are the most frequent type of neighborhood types, but some coworking chains grow by having coworking spaces with coffee shops in hip city residential neighborhoods while other spaces go to beach towns. These coworking chains understand their customers and know how to run profitable spaces in neighborhoods that would be difficult for chains that need to fit a certain mold.

Launchpad is a great example of this business model – their business model focuses on what they call momentum markets – “mid-sized cities that recognize the importance of retaining talent and building momentum as the American economy shifts.” Their focus on finding mid-size hometowns that creative entrepreneurs are moving back to has led them to open coworking spaces in Nashville, Newark, Memphis, and Stockton, CA – none of these are necessarily close to each other, but they are bound by a similar size and culture.

Three locations in downtown Seattle, Portland, and Denver may have more in common than three locations in Denver, Colorado Springs, and Pueblo – geographic proximity does not equate to culture similarity. Three downtown locations are probably going to have similar makeups in terms of community collaboration, walking traffic, surrounding restaurants, and client demographics. There’s a simplicity in replicating the exact same space in the exact same neighborhood (every city has an Uptown equivalent, an arts district, and so on.)

That being said, there’s also disadvantages too – strong local leadership is a must. Additionally, it takes more planning to do a size profile expansion model. The current chains doing this have this expansion model in mind from day one. It requires a strong vision and is less organic than the previous two growth models.

Oddballs

These are the type of locations that have, for example, one campus in one city and another in a completely different city – sometimes the founder moved to his hometown from a larger city, or a personal connection made opening a new space in a different city viable. 25N Coworking, for example, has two locations in Illinois – and one in Frisco, Texas. Coworking Station has three locations in dixie North Carolina and one in a small town in Massachusetts. The sister branch to Sevenco‘s Irvine, CA location can be found in Troy, MI.

At the end of the day – coworking is flexible. Good operators are able to make it work. As the coworking market expands and matures, we may see these some business strategies and models win out and claim a majority market share. Right now, the market is open to new ideas and as-of-yet-undiscovered strategies to win. As a personal note from us as consultants in the coworking world – this is the fun part. We enjoy watching and helping the industry come-of-age and forge ahead to new opportunities. It’s a fun time to work with people and properties.

The future is yours.

As the coworking market expands and matures, we may see these some business strategies and models win out and claim a majority market share. Right now, the market is open to new ideas and as-of-yet-undiscovered strategies to win. This is your time, and we’re excited to see what you come up with.