How to estimate your potential coworking income

To help property owners assess the potential value of their spaces when converted to coworking, we’ve built a Property Planning Tool to crunch the numbers and come up with monthly financials for five different coworking models. Answer 6 questions about your property, and we’ll tell you what type of coworking makes sense for you in a customized feasibility report.

We’ll generate a free sample P&L for your space, created from real-world data from businesses across the US.

Get your free coworking property assessment6 questions. That’s all we need to estimate your coworking potential.

Question 1: Lease Rate

This is should be the base rent for a modified gross lease. This is the rental rate you are charging per square foot for the first year for the entire space. If your lease has an escalation clause, you can use the average rate across the term of the lease (although, for the purposes of this comparative business model estimation, it doesn’t usually change the end result too much.)

Question 2: NNN Rate

NNN is the additional rent paid on top of the modified gross lease rate. NNN often includes property taxes, CAM, maintenance, insurance, etc. This rate is often quoted in property listings and typically ranges from $4 to $12 per square feet per year. If you charge full gross, we’ll ask you to separate out the charges into modified + NNN so we can estimate different coworking business models – depending on the model, the landlord, the operator, or both jointly may be responsible for these fees.

Question 3: Square Feet

Enter the total Usable Square Footage (USF) of your property or subdivision. Don’t include common area square footage outside of your potential coworking location – coworking spaces are expected to have their own common areas, kitchen, restrooms, etc. We’ll automatically allocate part of your USF for these areas while making our calculations.

Question 4: TI Budget

TI stands for tenant improvement. This budget (sometimes called a capital addition budget) is how much the landlord offers to the renter in order to update and improve the space for the new use, including building walls, new lighting, paint, etc. This is often quoted in dollars per square foot. In 2019, landlords on average offered 12 to 18 months worth of rent for a 10-year lease. The TI budget you need to attract tenants in your area affects the viability of some coworking models – if you need a high TI budget to attract commercial tenants, you might be better off spending that TI budget on your own coworking buildout. If you can rent your space at a high lease rate without any TI budget, the additional cost of a coworking buildout might not make comparative sense against a traditional lease.

Question 5: Space Class

Office commercial real estate is often categorized by A, B, and C classes. Class A is your new and modern office. Class B is your modern but dated office building. Class C spaces are the least desirable and often represent a space that is functional but it hasn’t been updated in a few decades. We use this value to estimate your general buildout and profit potential – class A coworking spaces have an expensive buildout budget, but the profit potential is much higher than class C spaces.

Question 6: City Tiers

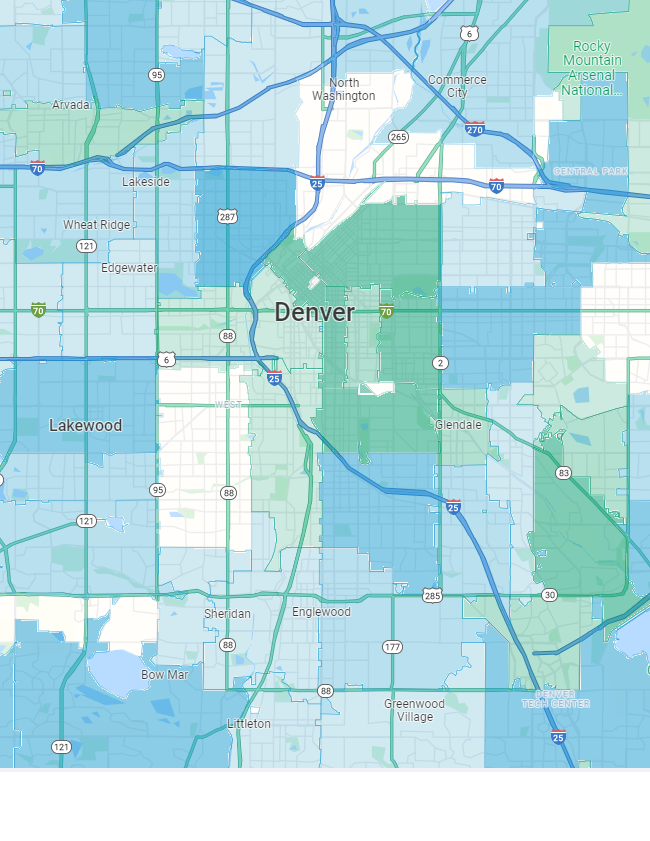

City tiers are strongly correlated with population size and density. New York City, Miami, LA, Chicago are examples of Tier A. Denver, Nashville, Indiapolis, and others ranging from 700,000 to 1.5 million people are good examples of Tier B. Tier C cities generally range from 250,000 to 700,000, but it starts to become more subjective. For the purposes of this estimation, suburbs can include any greater metro area of a city (whether New York or Portland), and exurbs should be selected for any small town or rural area without a commuter city within standard driving distance.

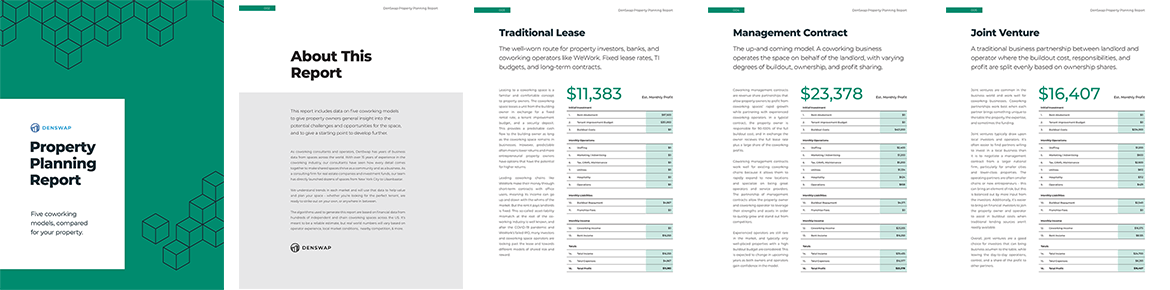

What business models does the report estimate?

DenSwap’s free PDF report is generated in seconds and shows a financial breakdown and comparison of 5 different coworking business models.

Traditional Lease

Mgmt Contract

Joint Venture

Franchise

Start Your Own

Information is power.

Our goal is to provide as much useful information as possible to the next generation of coworking owners and operators as possible. A strong, well-run industry serves us all – property owners, operators, consultants, and tenants alike. Once you’ve run the numbers and are considering next steps, talk to us and see how we can come alongside you and support you in your goals.